advantages and disadvantages of llc for rental property

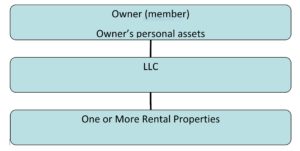

The main reason for this is to protect yourself from being personally liable. Lets say for example your LLC has the title to rental property.

Llc For Real Estate Investing Step By Step Guide Pros Cons

Forming an LLC will help to protect your personal assets.

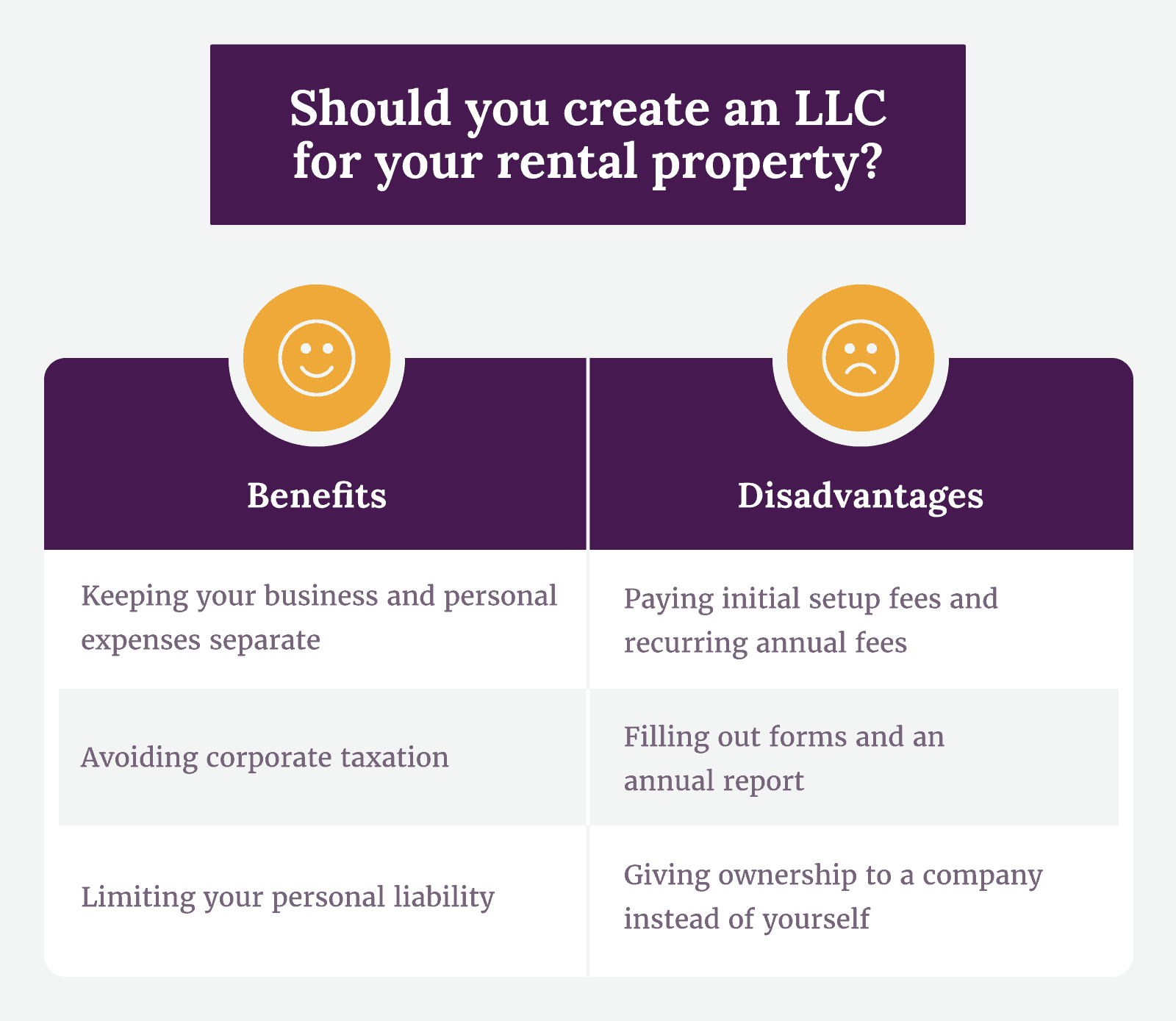

. One of the disadvantages of using an LLC for a real estate rental. Here are some of the benefits of investing in rental properties. In this article well look at the advantages and disadvantages of forming a LLC for rental property owners.

If rental properties are part of your investment portfolio then. Paying initial setup fees and recurring annual fees. Ad Forming an LLC provides liability protection for any type.

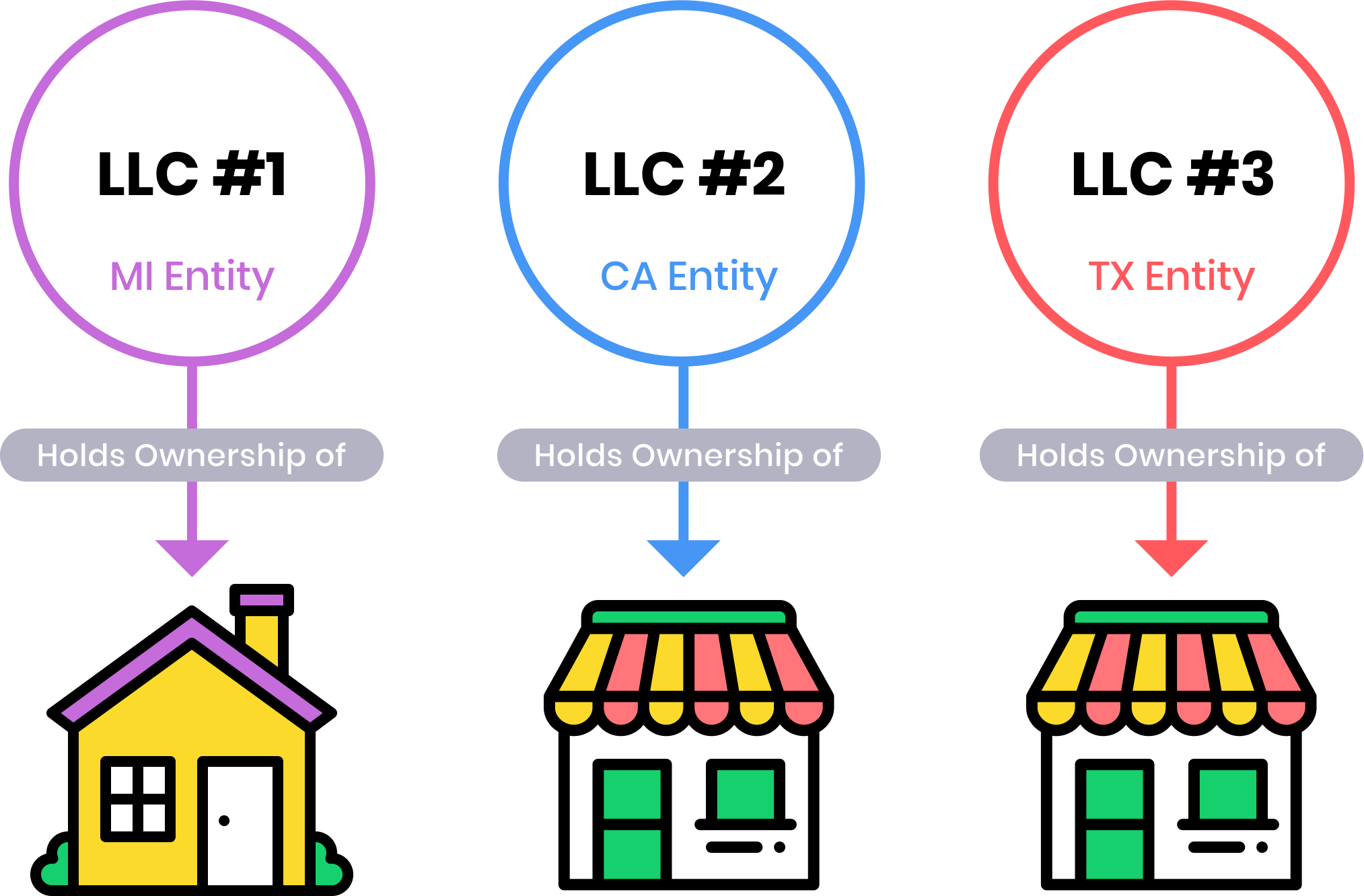

Forming an LLC and acquiring a business license come with many setup. Using an LLC to own your property rental business has key advantages when it comes to liability protection insulating your assets and ownership flexibility. An LLC formed in California has foreign qualified to do business in Colorado where the LLC owner has purchased a rental property.

Pros of an LLC for rental property. Depending on the state an LLC can cost between 40 and 500 to set. There are many advantages to establishing an LLC for your rental properties.

Upfront Costs One of the major disadvantages of setting up an LLC for rental property is the upfront costs. Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too. Disadvantages of an LLC for a rental property.

Disadvantages of Creating an LLC for Rental Property 1. The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline. One of the primary benefits of holding your rental property through an LLC is the limitation of liability.

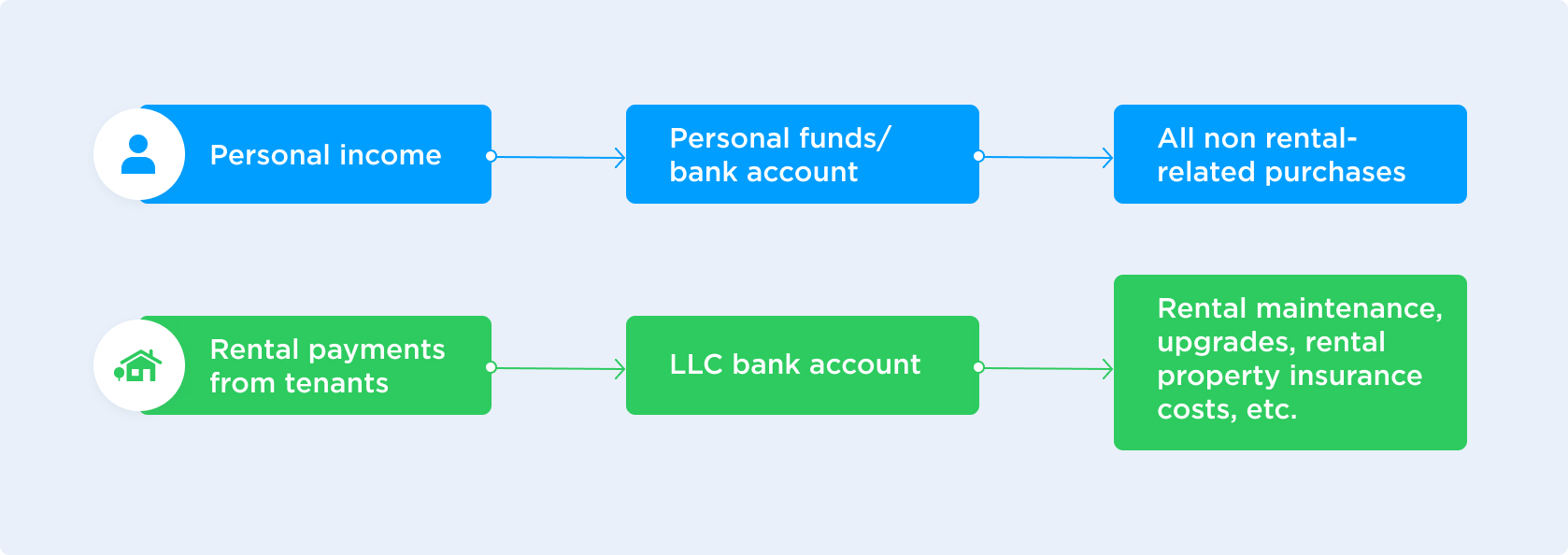

The advantages and disadvantages to owning rental property in an LLC Real estate investors -just like every business owner- need to track their income and expenses so. List of the Pros of Using an LLC for a Rental Property. A limited liability company is better for asset protection.

LLCs are able to utilize pass-through. Advantages of Rental Properties. However some drawbacks may arise.

Advantages and disadvantages of llc for rental property Wednesday March 2 2022 Edit. Depending on your specific situation and unique circumstances the following may be considered pros for. The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability.

Using an LLC to own your property rental business has key advantages when it comes to liability protection insulating your assets and ownership flexibility. This is the dream that most people have when. The key disadvantages relate to.

Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. LLCs offer several tax benefits for rental property with set expenses that can be deducted and ways to minimize total payable tax costs. Advantages and Disadvantages of an LLC for Rental Property While LLCs have many benefits they also come with some drawbacks.

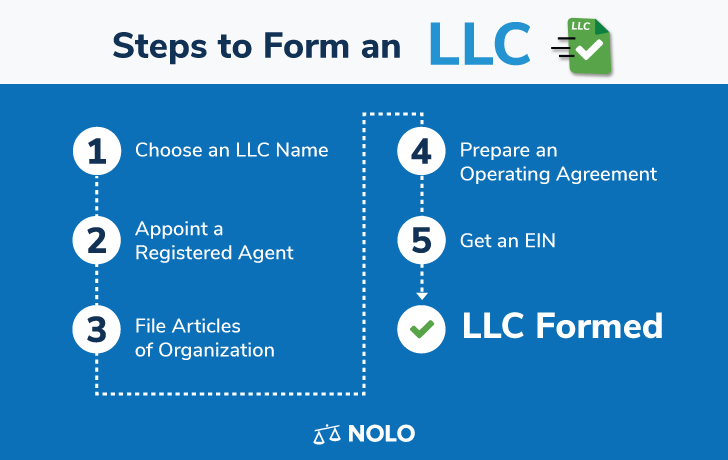

What Is An Llc Limited Liability Company Nolo Nolo

Should I Transfer The Title On My Rental Property To An Llc

Should You Form An Llc For Rental Property 2022 Bungalow

Should You Put Rental Properties In An Llc White Coat Investor

Should I Transfer The Title On My Rental Property To An Llc

Advantages Disadvantages Of Llc Limited Liability Company

Llc For Rental Property Pros Cons Explained Simplifyllc

What Is The Difference Between A Trust And An Llc Duckett Law Office

Llc For Rental Property What Should Real Estate Investors Do

Why Depreciation Matters For Rental Property Owners At Tax Time Stessa

The Series Llc For Real Estate Deals Griffith Xidias Law Group

Chapter 34 Llc S And Llp S Ppt Download

How To Use An Llc For Rental Property

Creating Llc For Rental Property Ny Rent Own Sell

What Are The Advantages And Disadvantages Of Renting Toughnickel

How To Start A Real Estate Holding Company In 6 Steps

How To Use An Llc For Rental Property Tax Benefits More

Llc For Rental Property What Should Real Estate Investors Do

20 Pros And Cons Of Creating An Llc For Your Rental Property